The relentless rally in equities faces a fresh threat over the next few weeks with the world’s biggest money managers set to unload as much as $150 billion of stocks.

JPMorgan Chase & Co. projects real-money portfolios, including those of sovereign wealth and pension funds, will tilt back in favor of bonds to meet allocation targets, in the largest rebalancing flows to the asset class since the fourth quarter of 2021. The periodic rejigging could knock off as much as 5% from the price of global stocks, according to estimates by JPMorgan strategist Nikolaos Panigirtzoglou.

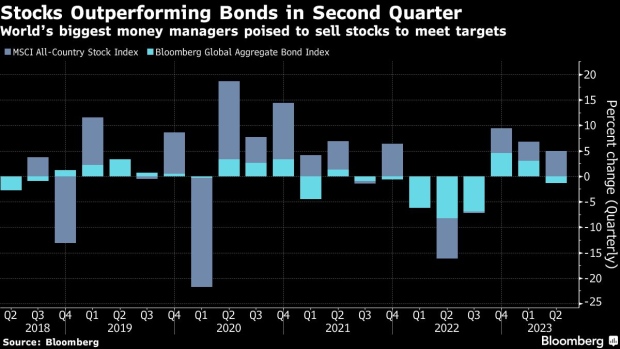

Pension funds and other institutional investors check their market exposures to make sure they meet strict allocation limits between equities and bonds every quarter- and month-end. Equities have outperformed bonds so far this quarter, leaving portfolio managers needing to cut their stocks exposure to meet their long-term targets.

“The last time we had such gap with equities and bonds in opposite directions was in the fourth quarter of 2021,” Panigirtzoglou said. “This rebalancing flow could create around a 3% to 5% correction in equities.”

The pension and sovereign wealth funds that form the backbone of the investing community typically rebalance their market exposures every quarter to achieve a mix of 60% stocks and 40% bonds or a similar exposure. So far this quarter MSCI’s all-country stock index is up 5% while the Bloomberg global-aggregate bond index is down 1.3%.