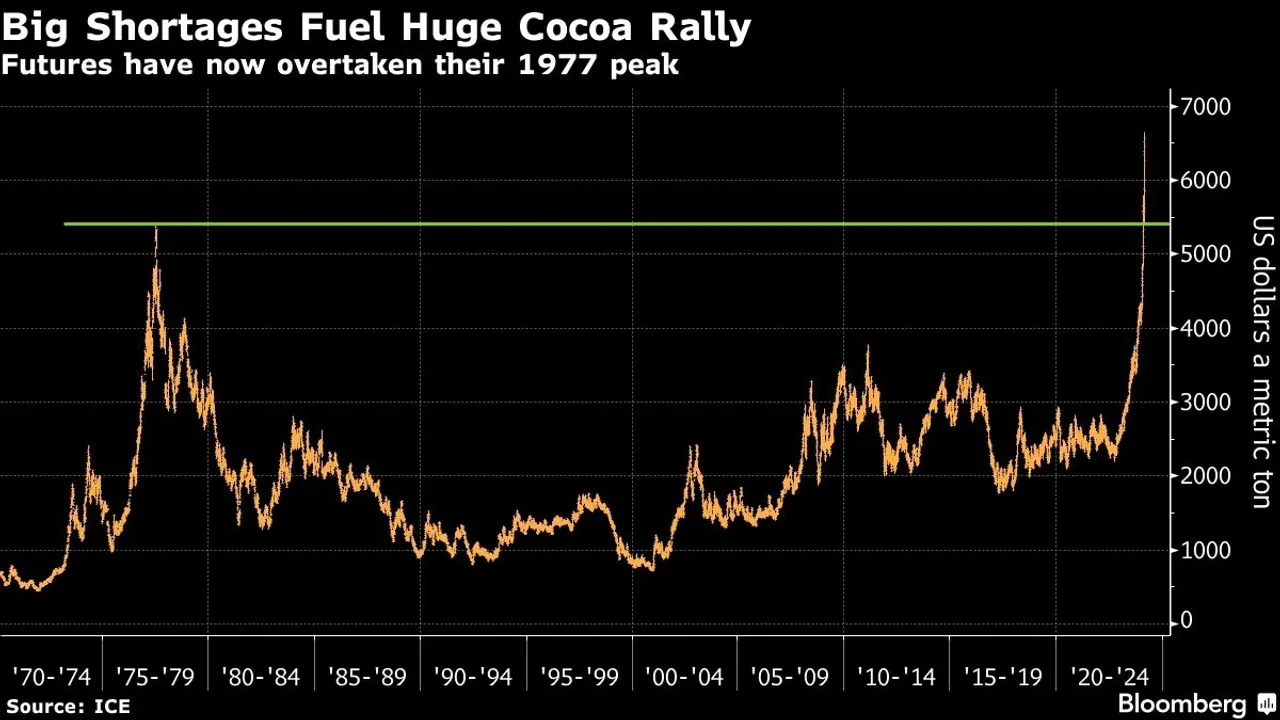

Amid a sharp decline in cocoa production in Ghana due to severe weather conditions and disease outbreaks, cocoa futures have soared, crossing an unprecedented threshold of $10,000 per ton. This surge, doubling prices within the year, reflects acute global supply anxieties, especially with Ghana being one of the world’s leading cocoa producers. The dramatic increase has profound implications for economies, trade balances, and consumer prices worldwide.

Root Causes of the Rally

Experts attribute the historic rally in cocoa futures to a combination of adverse weather conditions and disease affecting crops in Ghana, a key player in the global cocoa market. The situation is exacerbated by similar production challenges in the Ivory Coast, another major cocoa producer. These disruptions have led to a tight supply in the global market, triggering a spike in futures prices. The International Cocoa Organization’s forecast of a significant global cocoa deficit for the 2023/24 season has only added fuel to the fire, with concerns over supply contract defaults and reduced exports from other producers like Nigeria further compounding the issue.

Looking Ahead

As the cocoa market navigates through this tumultuous period, stakeholders are closely monitoring the situation in Ghana and other key producing countries. The potential for continued high prices depends on various factors, including the success of efforts to combat the disease and improve weather conditions affecting cocoa crops. In the meantime, the industry may need to brace for a period of high volatility, with potential ripple effects on global trade, economies, and consumer prices.

As the world watches this unprecedented surge in cocoa futures, the longer-term implications for the global cocoa market remain uncertain. The current crisis highlights the vulnerability of global commodity markets to environmental and health shocks, underscoring the need for resilience and sustainability in agricultural practices. As stakeholders grapple with these challenges, the situation serves as a reminder of the interconnectedness of global markets and the far-reaching impact of supply chain disruptions.