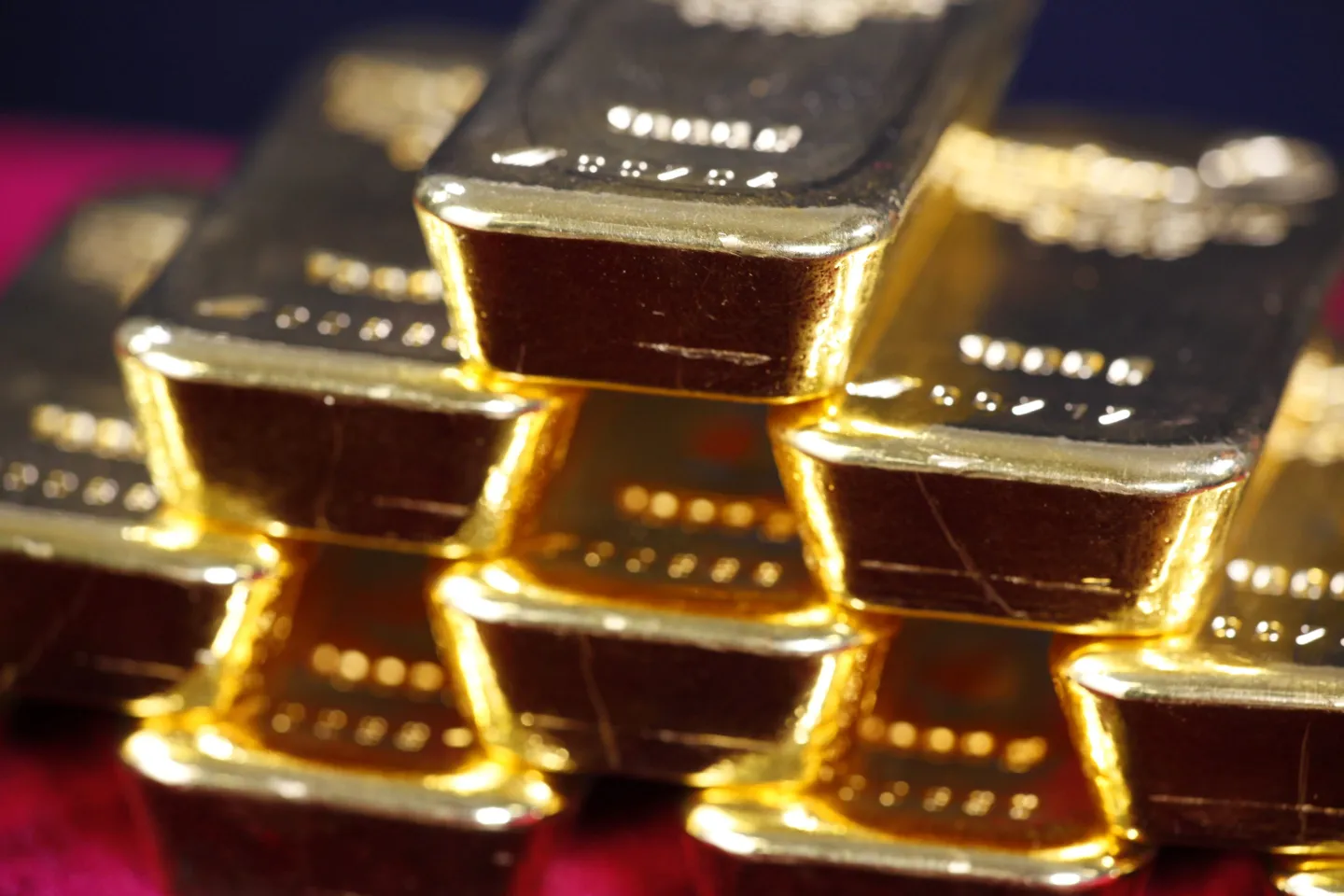

JPMorgan Chase & Co. will deliver gold bullion valued at more than $4 billion against futures contracts in New York in February, at a time when surging prices and the threat of import tariffs are fueling a worldwide dash to ship metal to the US.

Fears of imminent tariffs on imports following the election of US President Donald Trump have caused prices for gold futures on Comex to surge over spot prices in London. Spot prices shot to record highs this week, but the additional premium on Comex has created a lucrative arbitrage opportunity for the handful of banks that can quickly fly bullion between key trading hubs.

Similar pricing dynamics have emerged in other Comex contracts too, and the disparity has become so large that traders have started flying silver into the country. The precious metal is usually too cheap and bulky to justify the cost of airfreight, and one industry veteran says it’s the first time they’ve seen it happen.

Source: FORTUNE