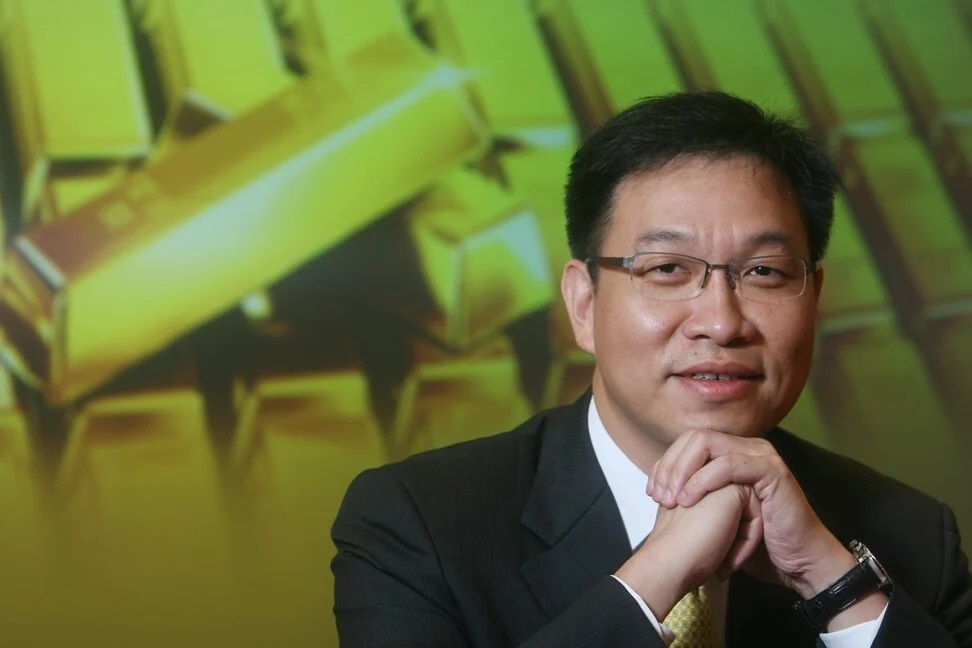

Charles Li Xiaojia, CEO of Hong Kong Exchanges and Clearing Limited, to step down earlier than expected. Photo: SCMP

Charles Li Xiaojia will bring forward his retirement and step down as the head of Hong Kong’s stock exchange operator 10 months before his contract expires, in a surprise announcement that fuels speculation about his successor at the helm of Asia’s third-largest stock market.

Li’s right-hand man at Hong Kong Exchanges and Clearing, Calvin Tai, will take his place on an interim basis from January 1, while the search continues for a permanent replacement.

Li, who turned 59 in March and is one of the longest-serving chief executives of a global financial marketplace, informed HKEX’s board on Tuesday that he wished to retire from the role on December 31 the exchange said in a filing.

HKEX has been the world’s largest IPO market in seven of the past 11 years. Photo: Agence France-Presse

“For Li to retire earlier than scheduled may mean that HKEX has already found a potential successor. It may also be because Li has found a new job,” said Christopher Cheung Wah-fung, a lawmaker representing the financial services sector.

Li, a former oilfield worker, journalist and banker, would like to have more time to plan his next career move, according to two sources familiar with his thinking, who said Li has not yet landed another position.

“Good progress has been made on the chief executive search process, and we will update the market when appropriate,” said Laura Cha Shih May-lung, HKEX chairwoman who is heading the selection committee looking for Li’s successor.

Hong Kong’s exchange is keen to find a leader that can develop its role as a venue for Chinese companies to raise capital from international investors. Even as the city reels from the impact of the coronavirus pandemic and social unrest, its capital markets are thriving.

Li is best known as the architect of the Connect programme, a series of cross-border investment channels that allow global investors to tap China’s yuan-denominated A shares and bonds, while letting Chinese institutions and individuals invest in shares and financial instruments listed in Hong Kong and London.

More recently, Li spearheaded the biggest reform of Hong Kong’s listing regulations in three decades, when the exchange opened its doors in 2018 to companies with dual-class shareholdings to raise capital. That paved the way for Alibaba Group Holding , owner of this newspaper, to launch a US$12.9 billion secondary listing last November.

The listing reforms also opened the way for pre-revenue pharmaceutical researchers and biotechnology companies to raise funds in Hong Kong. Under a three-year strategic plan unveiled in 2019, HKEX would tap a wider range of financial products to extend its lead over rival exchanges, Li said.

“His replacement needs to understand both China and Hong Kong markets, as well deepen its connections with China market and the rest of the world,” Cheung said.

Tai, aged 58, is currently HKEX’s co-president and chief operating officer and is just two years shy of the exchange’s mandatory retirement age. He joined the Hong Kong Futures Exchange as head of products in 1998, before it merged with the stock exchange and three clearing houses in 2000. He overseas exchange, clearing and risk management of both the securities and derivatives business.

HKEX’s board said it is confident that, under Tai’s leadership, HKEX will deliver on the objectives as set out in the 2019-2021 plan and that Li will remain as a senior adviser for six months to help ensure a smooth transition.

“The [Hong Kong stock] exchange is a tremendous institution with a tremendous cultural heritage. It‘s going to carry on, obviously under a new leadership,” said Li during an August 28 webinar with the South China Morning Post.

Calvin Tai Chi-kin is stepping up as interim head of Hong Kong’s stock exchange operator. Photo: SCMP

Li said during the August webinar that he was retiring early to allow the board more time to find a suitable successor. Secondly, making a change during the coronavirus pandemic meant that the HKEX was not in the middle of an important project and thirdly, it encouraged senior industry professionals to take the opportunity seriously.

“Unless that person thinks the job is truly available, it’s hard to have a conversation,” said Li during the webinar.

Born in Beijing, Li spent his childhood in Gansu province in the country’s rural northwest. He got his first job at the age of 16 on an offshore oil rig.

Four years on, Li signed up for a course in English Literature at Xiamen University. After graduating in 1984, he worked as a reporter for China Daily for two years before going on to earn two more degrees in the United States, including a law degree from Columbia University.

In 1994 he began his career as an investment banker with Merrill Lynch in New York. The bank would move Li to Hong Kong in 1995 and make him president for China in 1999. In 2003, he joined JPMorgan as its China chairman, before moving to HKEX in 2010, the city’s highest-paid financial job.

Li was voted the Businessperson of the Year in 2019 by the DHL-SCMP Hong Kong Business Awards for spearheading the reforms at the exchange a year earlier.

“Being chief executive of HKEX has been the highlight of my career to date,” Li said on Tuesday. “It is now the right time for me to begin to pass the mantle to the next generation of HKEX leaders.”

Credit : This article appeared in the South China Morning Post print edition as: Stock exchange chief to step down 10 months early – By Enoch Yiu

Related Posts

The US has $36 trillion in debt. What does that mean, and who owns it?

On Sunday, a key congressional committee in the United States approved President Donald Trump’s new…

Anand Mahindra on India becoming 4th largest economy: “For us to keep Rising, India needs…”

Mahindra Group chairman Anand Mahindra recently took to social media to acknowledge India’s achievement of becoming world’s…

Africa’s largest bauxite producer cancels 46 mining licenses amid sector reform

The action is part of Guinea’s sweeping sector-wide reform aimed at curbing regulatory violations, boosting…

Gulf states channel billions into Africa as China revamps financial model

Gulf sovereign wealth and private capital are moving swiftly to plug a growing gap in…