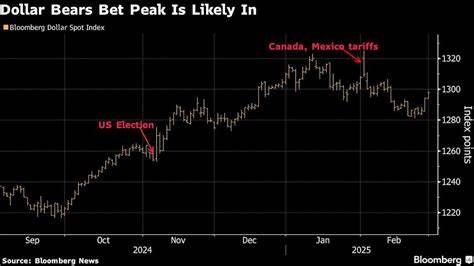

President Donald Trump’s tariff threats once again lifted the dollar last week, but a growing group of investors is betting against the greenback amid signs the US economy is cooling and on concern a trade war will weaken it further.

The expanding chorus of greenback bears includes asset managers Invesco and Columbia Threadneedle and hedge fund Mount Lucas Management. On Wall Street, Morgan Stanley and Societe Generale are warning clients that going long the dollar is an overcrowded trade that may not hold up.

They’re looking past the daily gyrations sparked by tariff announcements, and as they see it, the narrative around the greenback is only darkening. Instead of deriving support from the prospect that import levies could reignite inflation and keep interest rates elevated, there’s now concern that all the uncertainty around tariffs risks undermining an economy that already shows signs of cooling.

The result is that market expectations for Federal Reserve interest-rate cuts have intensified, diminishing the greenback’s appeal. And the aura of US economic exceptionalism that underpinned the dollar’s 7.1% surge last quarter is dimming as investors ponder Trump’s domestic and foreign policies, that include efforts to slash federal expenses and broke a peace deal between Russia and Ukraine.

Source: FINANCE.YAHOO