In a move that took financial markets by surprise, Switzerland’s National Bank announced a reduction in its main policy rate by 0.25 percentage points to 1.5%. This strategic decision was made in light of the national inflation rate consistently staying below the 2% mark, a figure the Swiss National Bank (SNB) associates with price stability. With inflation expected to remain within this range in the coming years, this rate cut marks a notable shift in monetary policy for one of the world’s most stable economies.

Background and Rationalization

The Swiss National Bank’s decision comes at a critical juncture. Over recent months, Switzerland has witnessed inflation rates dipping back below the 2% threshold, prompting a reassessment of its monetary stance. Despite global economic uncertainties, the SNB’s updated forecast reflects confidence that inflation will not breach the price stability range any time soon. This preemptive rate cut is aimed at safeguarding the Swiss economy against potential deflationary pressures and the adverse effects of an overly strong franc, which could hamper economic growth and export competitiveness.

Implications for the Swiss Economy

The reduction in the policy rate is expected to have wide-reaching implications for the Swiss economy. By lowering borrowing costs, the SNB aims to stimulate domestic investment and consumption, thus supporting economic growth in a period of subdued inflation. Additionally, the move is likely to influence the value of the Swiss franc on the foreign exchange market, potentially making Swiss exports more competitive on a global scale. However, it also raises questions about the longer-term impacts on savers and the banking sector, which will have to navigate the challenges of a lower interest rate environment.

Global Context and Reactions

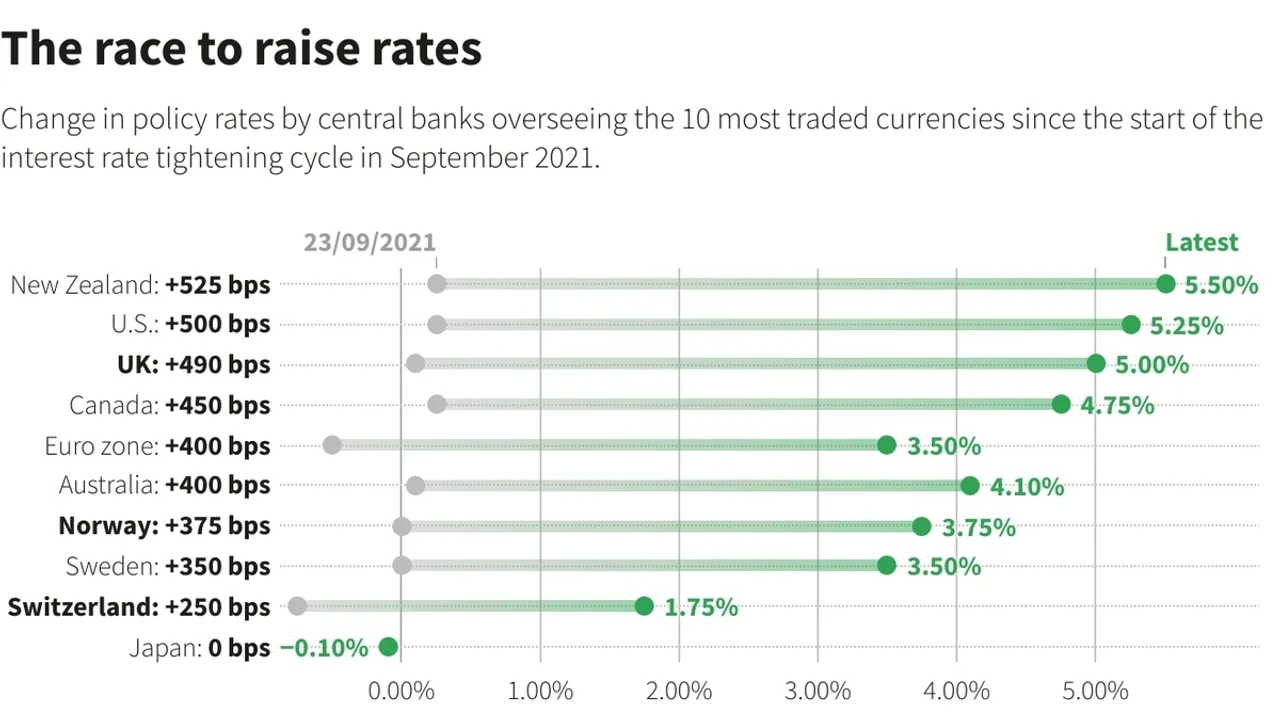

This decision by the Swiss National Bank places Switzerland at the forefront of major economies opting to cut interest rates in response to low inflation, setting a precedent that other central banks may follow. Financial analysts and investors around the world are closely monitoring the implications of this move, particularly in terms of its effects on global currency markets and international trade dynamics. The unexpected rate cut has sparked a lively debate among economists regarding the optimal monetary policy approach in an era of unprecedented economic challenges.

As the dust settles on this surprising announcement, the global financial community is left to ponder the ramifications of Switzerland’s bold move. With the SNB taking a stand against deflationary risks and currency overvaluation, other central banks might reevaluate their own positions in light of evolving economic indicators. This decision not only highlights the Swiss National Bank’s proactive and independent monetary policy strategy but also signals a potentially transformative phase in global economic governance, where the balance between fostering growth and maintaining monetary stability is more crucial than ever.